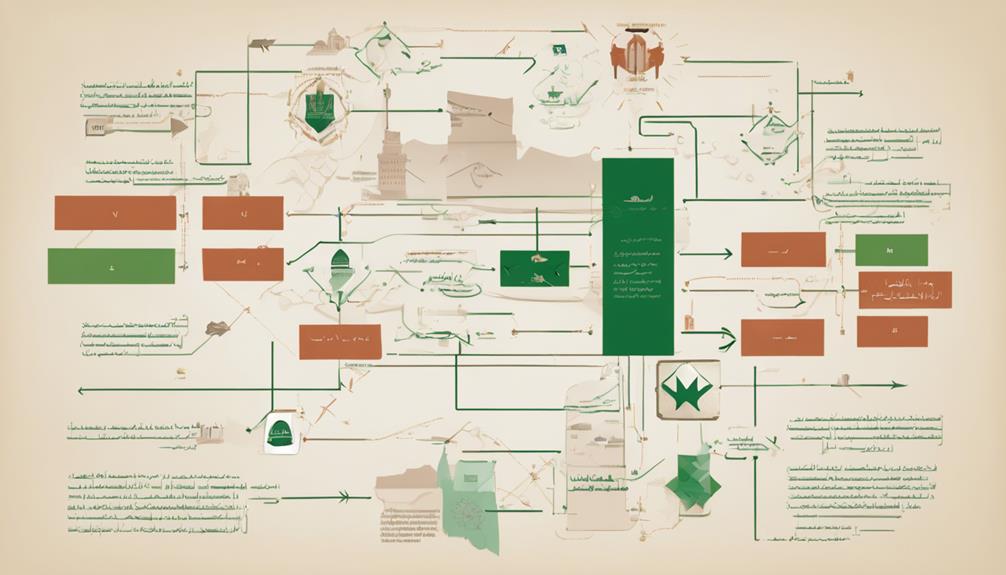

Establishing a business in Saudi Arabia requires a thorough understanding of the commercial registration process, which serves as the foundation for a company's legal existence and operational legitimacy in the kingdom.

The type of registration required depends on the business structure, with options including a limited liability company, joint-stock company, or branch of a foreign company.

At Dr. Abdulrazak Alfahal Law Firm, we guide clients through the process of submitting an application, paying the required fees, and obtaining necessary licenses and permits.

To guarantee compliance with Saudi Arabian law, it is vital to choose the correct type of registration and fulfilling post-registration compliance obligations. Our expertise ensures a nuanced understanding of these requirements, essential for traversing the complexities of doing business in Saudi Arabia.

Understanding Commercial Registration Requirements

Commercial Registration Saudi Arabia

Understanding Commercial Registration Requirements

Setting up a business in Saudi Arabia requires a thorough understanding of commercial registration requirements.

Dr. Abdulrazak Alfahal Law Firm emphasizes the importance of registering a business with the relevant authorities, including the Ministry of Commerce and Investment and the Saudi Arabian General Investment Authority.

The type of commercial registration required depends on the business structure, with options including a limited liability company, joint-stock company, or branch of a foreign company.

It is crucial to choose the correct type of registration to ensure compliance with Saudi Arabian law and avoid potential penalties or fines.

The commercial registration process involves submitting an application, paying the required fees, and obtaining the necessary licenses and permits.

As this process can be complex, Dr. Abdulrazak Alfahal Law Firm recommends seeking professional advice to ensure a smooth and successful registration.

Documents Needed for Application

At Dr. Abdulrazak Alfahal Law Firm, we guide clients through the preparation of necessary documents for commercial registration applications.

The required documents vary depending on the type of business and its ownership structure. However, some common documents needed for commercial registration in Saudi Arabia include:

A copy of the company's memorandum of association and articles of association, which outline the company's objectives, capital structure, and management framework.

These documents must be notarized and attested by the Saudi Arabian embassy or consulate in the country of origin.

Copies of the passports of all shareholders, directors, and managers, as well as their residence permits and identification cards, if applicable.

Proof of address, such as a utility bill or lease agreement, may also be required.

In addition, documents related to the company's business activities, such as a business plan, feasibility study, or license from the relevant regulatory authority, may be needed.

It is essential to certify that all documents are complete, accurate, and translated into Arabic, as required by the Saudi authorities.

Application Process and Timeline

Pursuing commercial registration in Saudi Arabia involves a multi-step process that requires meticulous planning and attention to detail.

At Dr. Abdulrazak Alfahal Law Firm, we guide clients through the process, ensuring all required documents are submitted and reviewed by the relevant authorities.

Once the documents are in order, we assist in reserving a trade name and obtaining approval from the Ministry of Commerce and Investment.

Next, we facilitate registration with the Chamber of Commerce and obtain a membership certificate.

We also ensure the company's Memorandum of Association and Articles of Association are notarized and attested by the relevant authorities.

These documents are then used to register the company with the Ministry of Labor and Social Development.

Our expertise enables us to complete the entire process in approximately 2-3 weeks, assuming all documents are in order and there are no unexpected delays.

Registration Fees and Costs

As business owners navigate the commercial registration process in Saudi Arabia, they must also consider the associated costs and fees.

At Dr. Abdulrazak Alfahal Law Firm, we understand that the registration fees in Saudi Arabia vary depending on the type of business, its capital, and the region in which it operates.

Generally, the costs can be categorized into three main components: the registration fee, the licensing fee, and the Chamber of Commerce fee.

The registration fee is typically around SAR 1,000 to SAR 2,000 (approximately USD 267 to USD 533), while the licensing fee can range from SAR 500 to SAR 5,000 (approximately USD 133 to USD 1,333), depending on the type of license required.

The Chamber of Commerce fee is usually around SAR 1,000 to SAR 2,000 (approximately USD 267 to USD 533) annually.

In addition to these fees, businesses may also need to pay for other expenses, such as notarization and legalization of documents, translation services, and consultancy fees.

Our team at Dr. Abdulrazak Alfahal Law Firm can guide you through the process and help you factor these costs into your budget to guarantee a smooth and successful registration process.

Post-Registration Compliance Obligations

After obtaining a commercial registration in Saudi Arabia, business owners must fulfill various compliance obligations to maintain a good standing with the authorities and avoid penalties or even license revocation.

Dr. Abdulrazak Alfahal Law Firm highlights that key compliance obligations include filing annual financial statements and renewing the commercial registration annually.

Businesses must also obtain any necessary licenses and permits specific to their industry or activities.

In addition, they must comply with labor laws, including obtaining any necessary visas and permits for foreign employees.

Tax compliance is also pivotal, with businesses required to register for VAT and file tax returns on a regular basis.

Failure to comply with these obligations can result in significant fines and penalties.

Consequently, it is essential for business owners to understand their compliance obligations and confirm they are met in a timely and accurate manner.

Frequently Asked Questions

Can I Register a Commercial Business With a Non-Saudi Partner?

In Saudi Arabia, Dr. Abdulrazak Alfahal Law Firm advises that foreign partnership is permissible, but specific regulations and restrictions may apply. The Saudi Arabian General Investment Authority (SAGIA) governs foreign investment, and certain requirements must be met for a non-Saudi partner to register a commercial business.

How Do I Change My Commercial Registration Details?

To modify commercial registration details, Dr. Abdulrazak Alfahal Law Firm submits an application to the relevant authorities, accompanied by required documents and fees, specifying the changes needed, and guaranteeing conformity with all applicable laws and regulations.

Can I Register Multiple Businesses Under One Cr?

At Dr. Abdulrazak Alfahal Law Firm, we advise that registering multiple businesses under one commercial registration is possible, but it depends on the specific laws and regulations of the jurisdiction, as well as the type and scope of the businesses involved.

Do I Need to Renew My Commercial Registration Annually?

At Dr. Abdulrazak Alfahal Law Firm, we emphasize the importance of annual commercial registration renewal to ensure ongoing compliance with regulatory requirements and maintain business operations. Failure to renew may result in penalties, fines, or even business closure.

Can a Foreigner Own 100% of a Saudi Business?

At Dr. Abdulrazak Alfahal Law Firm, we advise that foreigners are permitted to own 100% of certain business ventures in Saudi Arabia, but this varies depending on the industry, type of entity, and applicable laws and regulations, often requiring local sponsorship or partnership.

Conclusion

Commercial Registration Saudi Arabia

Understanding Commercial Registration Requirements

Dr. Abdulrazak Alfahal Law Firm advises that commercial registration is a mandatory requirement for all businesses operating in Saudi Arabia. The Ministry of Commerce and Investment (MCI) is responsible for issuing commercial registrations, which serve as proof of a company's legal existence. To obtain a commercial registration, businesses must meet specific requirements, including having a valid trade name, a registered office address, and a clear business objective.

Documents Needed for Application

To apply for commercial registration, the following documents are required:

- A completed application form

- A copy of the company's Memorandum of Association (MOA)

- A copy of the company's Articles of Association (AOA)

- Proof of payment of registration fees

- A copy of the business owner's identification documents (e.g., ID card, passport)

- A copy of the lease agreement for the registered office address

Application Process and Timeline

The application process for commercial registration typically takes 2-5 working days. Once the required documents are submitted, the MCI will review the application and issue a commercial registration certificate if all requirements are met.

Registration Fees and Costs

The registration fees for commercial registration in Saudi Arabia vary depending on the type of business and its capital. The fees range from SAR 500 to SAR 5,000.

Post-Registration Compliance Obligations

After obtaining a commercial registration, businesses must comply with ongoing obligations, including:

- Renewing the commercial registration annually

- Filing annual financial statements with the MCI

- Obtaining necessary licenses and permits

- Complying with labor and tax laws

Conclusion

Commercial registration is a vital step in establishing a business in Saudi Arabia. Dr. Abdulrazak Alfahal Law Firm can guide businesses through the process, ensuring compliance with all requirements and ongoing obligations.