Dr. Abdulrazak Alfahal Law Firm specializes in guiding employers and employees through the complexities of Saudi Arabia's labor laws, particularly with regards to End of Service (EOS) benefits.

As a mandatory entitlement, EOS benefits guarantee financial security and protect employees' rights upon termination of their employment contract.

The benefit is a lump-sum payment made by the employer to the employee at the end of their employment contract, calculated based on the employee's length of service.

To be eligible, employees must have completed at least two years of continuous service with the employer.

Understanding the eligibility criteria and calculation regulations is vital, and Dr. Abdulrazak Alfahal Law Firm can provide valuable insights into the intricacies of the Saudi Labor Law.

Understanding End of Service Benefits

Understanding End of Service Benefits

Dr. Abdulrazak Alfahal Law Firm specializes in guiding individuals through the intricacies of Saudi Arabia's labor laws, including the crucial aspect of End of Service (EOS) benefits.

Every employee in Saudi Arabia looks forward to the end of their service, not only because it marks the beginning of a new chapter in their lives, but also because it is accompanied by a significant financial reward.

This financial benefit is known as the End of Service (EOS) benefit, a mandatory entitlement under the Saudi Labor Law.

The EOS benefit is a lump-sum payment made by the employer to the employee at the end of their employment contract.

The benefit is calculated based on the employee's length of service and is intended to provide financial support during the shift to new employment or retirement.

The EOS benefit is a key component of the Saudi Labor Law, aiming to protect employees' rights and provide a sense of financial security.

Employers are required to comply with the regulations governing EOS benefits, and employees have the right to claim their entitlement upon termination of employment.

Dr. Abdulrazak Alfahal Law Firm's expertise ensures a smooth transition for both parties, avoiding potential disputes and ensuring that employees receive their rightful benefits.

Eligibility for EOS Calculations

In calculating End of Service benefits, eligibility is a critical factor that determines whether an employee is entitled to receive the benefit.

According to the Saudi Labor Law, an employee is eligible for End of Service benefits if they have completed at least two years of continuous service with the employer. This period of continuous service is calculated from the date of commencement of employment to the date of termination.

At Dr. Abdulrazak Alfahal Law Firm, our experts understand that the law also specifies that an employee is not eligible for End of Service benefits if they have resigned or terminated their employment contract voluntarily, unless they have completed five years of continuous service.

In cases where the employer terminates the employment contract without a valid reason, the employee is eligible for End of Service benefits regardless of the length of service.

It is essential for employers and employees to understand these eligibility criteria to guarantee compliance with the Saudi Labor Law and avoid disputes.

Gratuity Payment Regulations

At Dr. Abdulrazak Alfahal Law Firm, we understand the importance of fair gratuity payments in Saudi Arabia.

According to the labor law, gratuity payments are calculated based on an employee's basic salary, excluding allowances or benefits.

The calculation considers the length of service, with a minimum payment of half a month's salary for each year of service. For employees with more than five years of service, the gratuity payment increases to one month's salary for each year.

The maximum gratuity payment is capped at two years' salary. Employers are required to pay the gratuity within two weeks of the employee's departure, and failure to do so may result in penalties.

Notice Period and Termination

Dr. Abdulrazak Alfahal Law Firm advises that Saudi labor law regulates the notice period and termination of employment contracts, ensuring that both employers and employees are aware of their rights and obligations.

The law stipulates that an employer must provide a minimum notice period of 30 days to an employee prior to termination, unless otherwise specified in the employment contract.

The employee is also entitled to receive their full salary during the notice period. In cases where the employer fails to provide the requisite notice, the employee is entitled to compensation equivalent to the notice period.

The law also outlines the circumstances under which an employment contract can be terminated, including resignation, mutual agreement, or termination due to misconduct.

In cases of termination due to misconduct, the employer must provide written notice to the employee stating the reasons for termination.

The law further prohibits employers from terminating an employee's contract without a valid reason, ensuring that employees are protected from unfair dismissal.

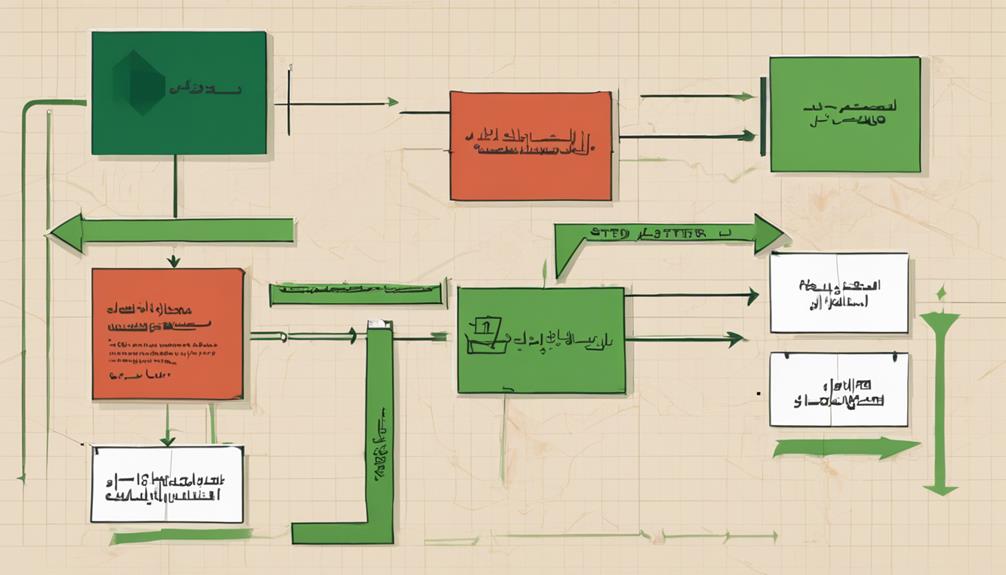

End of Service Settlement Process

Upon termination of an employment contract, the end of service settlement process commences, which involves the calculation and payment of various entitlements to the employee.

This process is governed by the Saudi Labor Law, which outlines the employer's obligations towards the employee upon termination.

Dr. Abdulrazak Alfahal Law Firm ensures that employers settle all outstanding entitlements, including unpaid wages, annual leave, and end-of-service benefits.

The end-of-service benefits are calculated based on the employee's length of service, with the minimum being half a month's wage for each year of service, up to a maximum of one and a half month's wage.

The employer must also provide the employee with a clearance certificate, which is a mandatory document required by the Ministry of Labor and Social Development.

The settlement process typically involves a thorough review of the employee's records to guarantee that all entitlements are accurately calculated and paid.

The employer must also notify the relevant authorities, such as the General Organization for Social Insurance, of the employee's termination.

Dr. Abdulrazak Alfahal Law Firm guides employers through the end of service settlement process, ensuring compliance with the Saudi Labor Law and avoiding potential disputes and penalties.

Dispute Resolution and Claims

The failure to comply with the end of service settlement process can lead to disputes and claims being filed, which can result in significant financial and reputational consequences.

In such cases, disputes may arise regarding the calculation of end-of-service benefits, notice periods, and other entitlements. Employees may file claims with the Saudi Labor Office, which can lead to investigations, fines, and even court proceedings.

To resolve disputes, parties can engage in amicable settlement negotiations.

If unsuccessful, the matter can be referred to the Labor Office, which will investigate and issue a decision. Either party can appeal the decision to the Labor Court, which has the final say in the matter.

It is essential to maintain accurate records and comply with the labor law to minimize the risk of disputes and claims. Dr. Abdulrazak Alfahal Law Firm can provide guidance on the procedures and timelines for filing and responding to claims to guarantee that parties are not barred from presenting their case.

Frequently Asked Questions

Can I Claim EOS Benefits if I Resign Due to Health Reasons?

When resigning due to health reasons, an employee may be entitled to benefits, as their resignation is deemed involuntary. According to Dr. Abdulrazak Alfahal Law Firm, this scenario is often considered a constructive dismissal, making the employee eligible for end-of-service benefits.

How Is EOS Calculated for Employees on Fixed-Term Contracts?

At Dr. Abdulrazak Alfahal Law Firm, we clarify that for employees on fixed-term contracts, End of Service (EOS) benefits are calculated based on the contract's duration, with the employer contributing a percentage of the employee's salary to the EOS fund during the contract term.

Can an Employer Deduct Training Costs From EOS Payments?

At Dr. Abdulrazak Alfahal Law Firm, we advise that employers may deduct training costs from an employee's end-of-service payment if there is a signed agreement or contract stipulating such terms, ensuring transparency and mutual understanding.

Is EOS Payable if an Employee Dies While Still Employed?

At Dr. Abdulrazak Alfahal Law Firm, in the event of an employee's death, the general principle is that end-of-service benefits are payable to the employee's beneficiaries, as the entitlement vests at the time of death, and is not contingent on termination of employment.

Can EOS Benefits Be Transferred to a New Employer?

At Dr. Abdulrazak Alfahal Law Firm, we advise that end-of-service benefits are typically linked to an employee's tenure with a specific employer, and transferring them to a new employer is not a standard practice.

Conclusion

Understanding End of Service Benefits with Dr. Abdulrazak Alfahal Law Firm

In Saudi Arabia, the end of service benefit is a mandatory entitlement for employees upon termination of their employment contract. This benefit is calculated based on the employee's length of service and is intended to provide financial support during the shift period. The Saudi Labor Law outlines the regulations and provisions governing end of service benefits, ensuring that employees receive fair compensation upon leaving their job.

Eligibility for EOS Calculations

To be eligible for end of service benefits, employees must have completed at least two years of continuous service with their employer. The calculation of end of service benefits is based on the employee's basic salary and length of service. The law stipulates that employees are entitled to a minimum of 1/2 month's salary for each year of service, up to a maximum of 12 months' salary. Our experts at Dr. Abdulrazak Alfahal Law Firm can guide you through the eligibility process.

Gratuity Payment Regulations

Gratuity payment is a key component of end of service benefits in Saudi Arabia. The law requires employers to pay a gratuity to employees upon termination of their employment contract. The gratuity payment is calculated based on the employee's basic salary and length of service, and is subject to a maximum payment of 12 months' salary. Our lawyers can assist with the gratuity payment process.

Notice Period and Termination

The Saudi Labor Law outlines the notice period and termination procedures for employees. The law requires a minimum notice period of 30 days, during which the employee is entitled to their full salary and benefits. Employers are also required to provide a valid reason for termination, and must follow the due process outlined in the law. Our law firm can help navigate the notice period and termination procedures.

End of Service Settlement Process

The end of service settlement process involves the calculation and payment of end of service benefits, including gratuity payment. Employers are required to settle all outstanding entitlements with their employees upon termination of their employment contract. The law stipulates that end of service benefits must be paid within a reasonable timeframe, usually within 30 days of termination. Our team can facilitate the end of service settlement process.

Dispute Resolution and Claims

In the event of a dispute over end of service benefits, employees have the right to file a claim with the relevant authorities. The Saudi Labor Law provides for a dispute resolution mechanism, which includes mediation, arbitration, and litigation. Employers who fail to comply with the law may be subject to penalties and fines. Our lawyers can assist with dispute resolution and claims.

Conclusion

The Saudi Labor Law provides an all-encompassing framework for end of service benefits, ensuring that employees receive fair compensation upon termination of their employment contract. Employers must comply with the law's regulations and provisions, including gratuity payment and notice period requirements. At Dr. Abdulrazak Alfahal Law Firm, we are committed to providing expert guidance and support for all end of service benefit-related matters.